Saudi Arabia is entering a pivotal phase in its economic transformation as it navigates a period of lower oil prices and rising financing needs, according to a new analysis by the International Monetary Fund (IMF). While the country benefited from strong oil revenues and accelerated reform-driven spending between 2022 and 2024, the year ahead will test its ability to sustain momentum under more challenging external conditions.

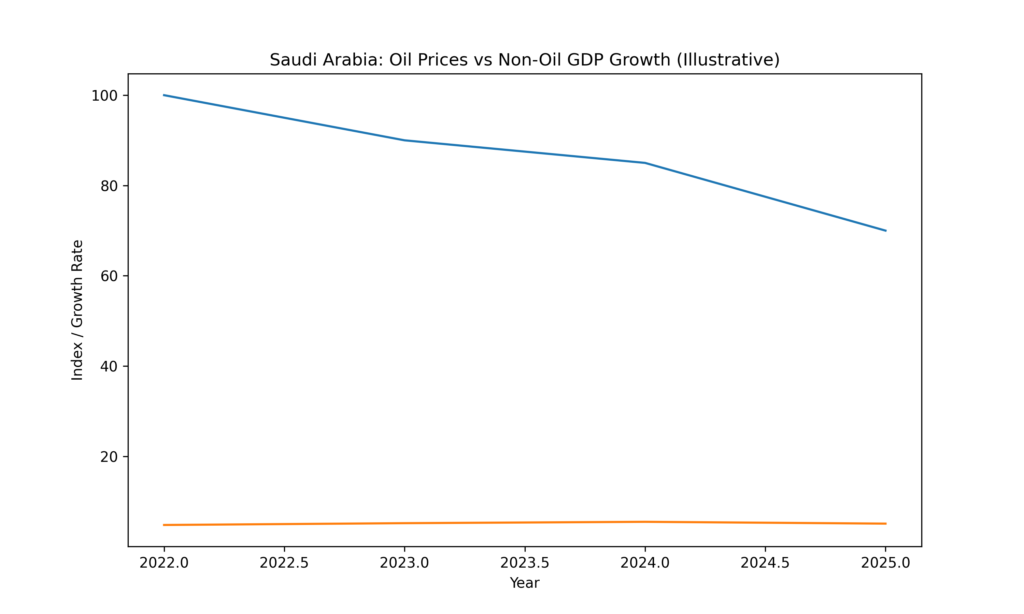

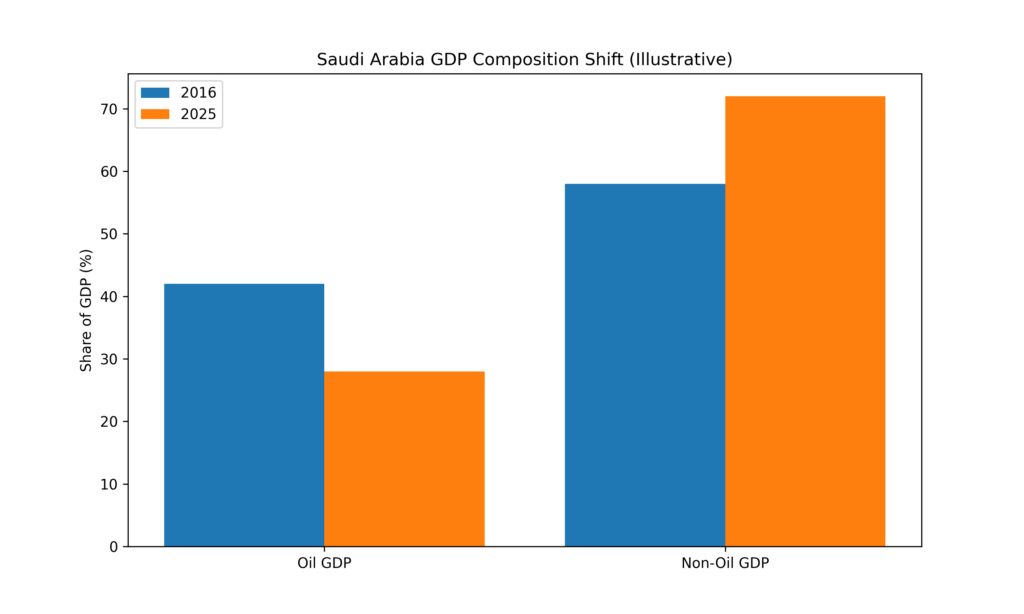

The IMF noted that Saudi Arabia is better positioned than in previous cycles to manage the downturn in oil prices. Despite crude prices falling nearly 30 percent from their 2022 peak, the non-oil economy continued to show strong growth through 2025. This resilience reflects the cumulative impact of Saudi Vision 2030 reforms, which have helped narrow diversification gaps with emerging markets and significantly improved the business environment, bringing it closer to advanced economy standards.

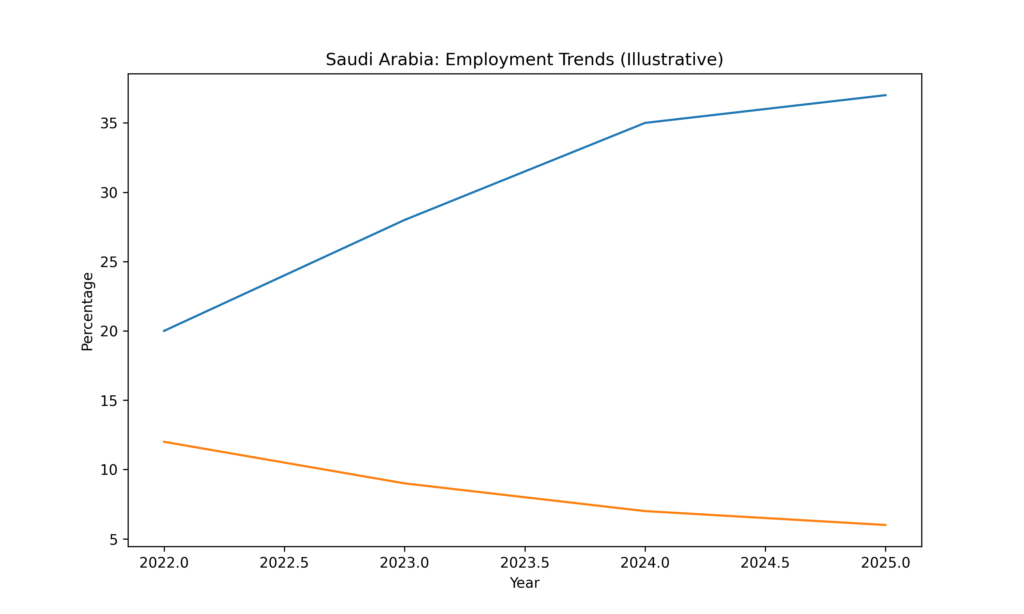

Private sector job creation has been a major contributor to this progress, with employment growth particularly strong among women. Unemployment rates have fallen to record lows, highlighting structural improvements in labor market participation. However, the IMF cautioned that continued reforms will be necessary to fully close remaining gaps with advanced economies and ensure the durability of these gains.

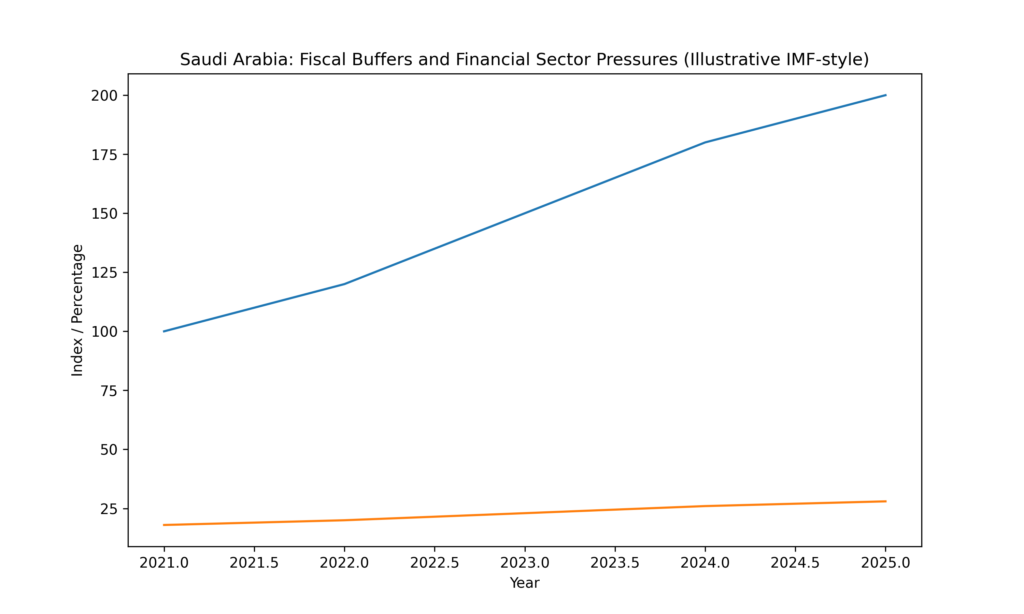

Looking ahead, the central challenge for Saudi Arabia will be sustaining reform momentum without reverting to the stop-and-go spending patterns seen after past oil booms. The IMF emphasised that diversification efforts must continue regardless of oil price movements. Saudi Arabia enters this phase from a position of relative fiscal strength, with low public debt-to-GDP ratios and substantial foreign asset buffers. At the same time, financing pressures linked to large-scale investment projects are increasing, making a consistent, multi-year fiscal framework essential to maintain long-term sustainability.

The IMF welcomed recent decisions to reprioritise major investment projects, noting that this has helped focus spending on higher-return areas while reducing the risk of economic overheating. Maintaining discipline through spending ceilings, expanding non-oil revenues, continuing energy subsidy reforms and improving spending efficiency will be critical over the medium term. Non-oil revenue has already doubled over the past five years, providing an important buffer against oil price volatility. Strengthening fiscal institutions, prudent debt management and a coherent strategy for managing sovereign assets and liabilities will further support Saudi Arabia’s reform objectives.

Financial sector stability remains another key priority. As Saudi banks increasingly rely on short-term external funding, the IMF stressed the importance of vigilant oversight by the Saudi Central Bank to prevent the build-up of vulnerabilities. Proactive use of prudential measures will be necessary to sustain healthy credit growth while preserving financial resilience. Over time, deeper capital markets-allowing firms to raise more financing through bonds and equity-could reduce pressure on banks, expand access to credit for small and medium enterprises, and create a more balanced funding structure for the economy.

The IMF also highlighted that Saudi Arabia’s future growth will depend increasingly on a skilled workforce and a dynamic private sector. Addressing skills shortages, particularly in fast-growing sectors such as technology and hospitality, will be essential to meet the needs of emerging industries. Continued implementation of reforms aimed at improving foreign investor access will help attract private capital and strengthen the investment climate. The sovereign wealth fund can play a supportive role by catalysing new projects and partnerships, while ensuring sufficient space for domestic and international private investors to participate.

Overall, the IMF concluded that prudent fiscal policy, strong financial oversight and deeper labor and investment reforms can help Saudi Arabia keep its economic transformation on track, even as oil revenues moderate and global conditions become more complex.

Source: International Monetary Fund (IMF), IMF Country Focus – “Saudi Arabia’s Path Forward Amid Lower Oil Prices”, by Amine Mati and Yuan “Monica” Gao Rollinson, December 18, 2025.